原先的策略不太嚴謹所以,增加了一些判斷標準,例如:

RSI 在 50 以上且模型預測漲 → 做多

RSI 在 50 以下且模型預測跌 → 做空

MACD 趨勢方向:僅當 MACD 與 Signal 線方向一致時才進場。

MA 趨勢:僅當價格在 MA20 或 MA50 之上(上漲趨勢)才考慮做多。

又再增加了止損/止盈規則例如:

止損 1%

止盈 2%

動態止損:依 ATR 設定止損距離(例如 ATR × 1.5)

def backtest_strategy(df, y_true, y_pred, test_index, initial_capital=10000,

position_size=0.1, atr_multiplier=1.5, take_profit_ratio=0.02):

"""

改進版回測:

1. RSI 濾波

2. ATR 動態止損

3. 固定止盈比例

4. 倉位管理

"""

df_test = df.iloc[test_index].copy()

df_test['True'] = y_true

df_test['Pred'] = y_pred

capital = initial_capital

equity_curve = [capital]

for i in range(1, len(df_test)):

price_prev = df_test['close'].iloc[i-1]

price_now = df_test['close'].iloc[i]

# 計算真實報酬率

ret = (price_now / price_prev) - 1

# 進場條件:RSI 濾波

rsi = df_test['RSI'].iloc[i]

pred = df_test['Pred'].iloc[i-1]

atr = df_test['ATR'].iloc[i]

enter_trade = False

if pred == 1 and rsi > 50: # 預測漲且 RSI 支持上漲

enter_trade = True

direction = 1

elif pred == 0 and rsi < 50: # 預測跌且 RSI 支持下跌

enter_trade = True

direction = -1

if enter_trade:

position_capital = capital * position_size

stop_loss = atr * atr_multiplier

take_profit = take_profit_ratio * price_now

# 模擬止損 / 止盈

if direction == 1: # 多單

if ret <= -stop_loss / price_now:

ret = -stop_loss / price_now

elif ret >= take_profit_ratio:

ret = take_profit_ratio

else: # 空單

if ret >= stop_loss / price_now:

ret = -stop_loss / price_now

elif ret <= -take_profit_ratio:

ret = take_profit_ratio

strategy_ret = direction * ret

capital += capital * position_size * strategy_ret

equity_curve.append(capital)

df_test['Equity'] = equity_curve

# 畫資金曲線

plt.figure(figsize=(12,6))

plt.plot(df_test['timestamp'], df_test['Equity'], label="Equity Curve", color="blue")

plt.axhline(initial_capital, linestyle="--", color="gray", alpha=0.7)

plt.title("Backtest Equity Curve (改進版策略)")

plt.xlabel("Time")

plt.ylabel("Capital")

plt.legend()

plt.xticks(rotation=45)

plt.show()

total_return = (capital / initial_capital - 1) * 100

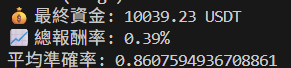

print(f"💰 最終資金: {capital:.2f} USDT")

print(f"📈 總報酬率: {total_return:.2f}%")

return df_test