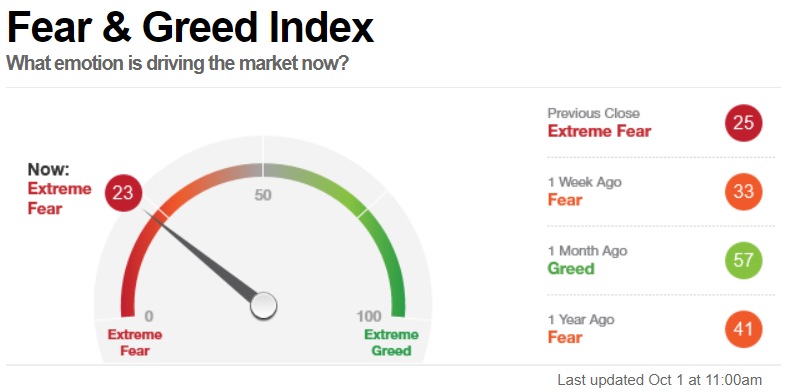

最近股市只有一個字

怕.jpg

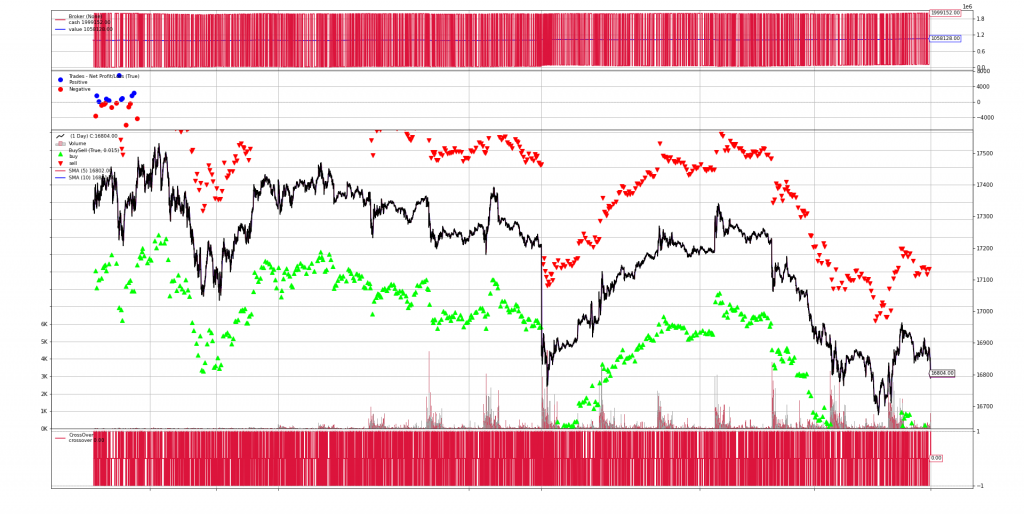

今天研究了大多的回測策略,大多都是以日計算,想想可不可以用 1分K 回測看看,研究了一下如何將永豐API的 Kbar 傳換成 backtrader 的 feeds,然後跑個簡單回測看看效果如何

今天來測試9/1到9/30 台指期的1分K,發現1分K資料量用圖呈現出來資料量也蠻驚人的

kbars = api.kbars(api.Contracts.Futures.TXF['TXF202110'], start="2021-09-01", end="2021-09-30")

df = pd.DataFrame({**kbars})

df.ts = pd.to_datetime(df.ts)

df

Close ts Volume Open High Low

0 17340.0 2021-09-01 00:27:00 1 17340.0 17340.0 17340.0

1 17325.0 2021-09-01 02:48:00 2 17326.0 17326.0 17325.0

2 17325.0 2021-09-01 02:54:00 4 17325.0 17325.0 17325.0

3 17321.0 2021-09-01 03:11:00 2 17322.0 17322.0 17321.0

4 17320.0 2021-09-01 03:23:00 1 17320.0 17320.0 17320.0

... ... ... ... ... ... ...

16399 16803.0 2021-09-30 23:56:00 119 16804.0 16805.0 16795.0

16400 16800.0 2021-09-30 23:57:00 138 16803.0 16808.0 16800.0

16401 16797.0 2021-09-30 23:58:00 94 16801.0 16802.0 16797.0

16402 16806.0 2021-09-30 23:59:00 120 16796.0 16807.0 16795.0

16403 16804.0 2021-10-01 00:00:00 94 16805.0 16809.0 16803.0

16404 rows × 6 columns

df.columns = ['close', 'datetime', 'volume', 'open', 'high', 'low' ]

df.set_index('datetime', inplace=True)

class pandasDataFeed(bt.feeds.PandasData):

params = (

('datetime', -1),

('high', 'high'),

('low', 'low'),

('open', 'open'),

('close', 'close'),

('volume', 'volume')

)

data = pandasDataFeed(dataname=newdf)

# feed data

cerebro.adddata(data)

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# add strategy

cerebro.addstrategy(SmaCross)

cerebro.broker.set_cash(1000000.0)

# run backtest

cerebro.run()

2021-09-01 08:50:00, BUY , Price: 17336.0

2021-09-01 08:50:00, BUY , Price: 17336.0

2021-09-01 08:54:00, SELL , Price: 17340.0

2021-09-01 08:54:00, SELL , Price: 17340.0

2021-09-01 09:18:00, SELL , Price: 17377.0

2021-09-01 09:18:00, SELL , Price: 17377.0

2021-09-01 09:26:00, SELL , Price: 17373.0

2021-09-01 09:26:00, SELL , Price: 17373.0

...

# plot diagram

cerebro.plot(height = 30, iplot = False)

plt.show()

結果呈現如下圖,買賣訊號非常多,似乎有些許的獲利,還要補上摩擦成本計算,明天來調整一下投入資金與策略微調吧