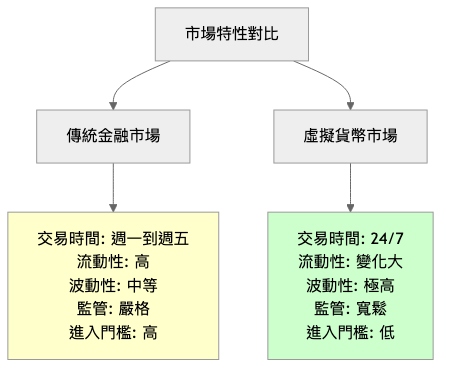

昨天我們了解了量化交易的基本概念,今天要深入探討虛擬貨幣的量化交易。還記得村裡第一次有人用手機支付買菜時,大家都覺得很神奇嗎?虛擬貨幣就像是金融世界的智慧型手機,帶來了全新的交易可能性!

24/7 交易

高波動性

程式化友好

多元化交易對

import pandas as pd

import numpy as np

class TrendFollowingStrategy:

"""趨勢跟隨策略 - 適合虛擬貨幣的高波動特性"""

def __init__(self, fast_period=20, slow_period=50):

self.fast_period = fast_period

self.slow_period = slow_period

def calculate_signals(self, price_data):

"""計算交易信號"""

# 計算移動平均線

price_data['fast_ma'] = price_data['close'].rolling(self.fast_period).mean()

price_data['slow_ma'] = price_data['close'].rolling(self.slow_period).mean()

# 生成信號

price_data['signal'] = 0

price_data.loc[price_data['fast_ma'] > price_data['slow_ma'], 'signal'] = 1 # 買入

price_data.loc[price_data['fast_ma'] < price_data['slow_ma'], 'signal'] = -1 # 賣出

return price_data

def backtest(self, price_data):

"""回測策略表現"""

data = self.calculate_signals(price_data)

# 計算策略收益

data['returns'] = data['close'].pct_change()

data['strategy_returns'] = data['signal'].shift(1) * data['returns']

# 計算累積收益

data['cumulative_returns'] = (1 + data['strategy_returns']).cumprod()

return data

虛擬貨幣市場經常出現劇烈波動後的回調:

class MeanReversionStrategy:

"""均值回歸策略 - 利用虛擬貨幣的過度反應特性"""

def __init__(self, lookback_period=20, std_threshold=2):

self.lookback_period = lookback_period

self.std_threshold = std_threshold

def calculate_signals(self, price_data):

"""識別過度偏離均值的機會"""

# 計算移動平均和標準差

price_data['mean'] = price_data['close'].rolling(self.lookback_period).mean()

price_data['std'] = price_data['close'].rolling(self.lookback_period).std()

# 計算 Z-score

price_data['z_score'] = (price_data['close'] - price_data['mean']) / price_data['std']

# 生成信號

price_data['signal'] = 0

price_data.loc[price_data['z_score'] > self.std_threshold, 'signal'] = -1 # 超買,做空

price_data.loc[price_data['z_score'] < -self.std_threshold, 'signal'] = 1 # 超賣,做多

return price_data

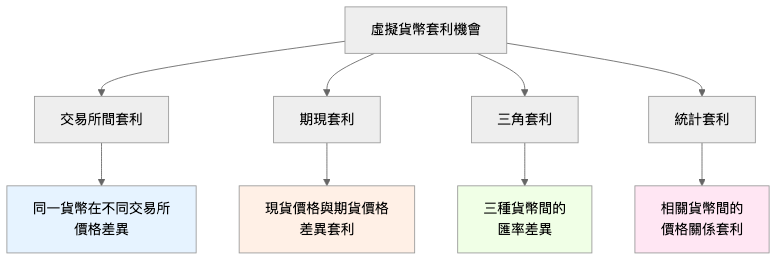

虛擬貨幣市場的效率性較低,存在多種套利機會:

期現套利利用現貨價格和期貨價格之間的價差:

class SpotFutureArbitrage:

"""期現套利策略"""

def __init__(self, entry_threshold=0.01, exit_threshold=0.005):

self.entry_threshold = entry_threshold # 進場閾值 1%

self.exit_threshold = exit_threshold # 出場閾值 0.5%

def calculate_basis(self, spot_price, future_price):

"""計算基差(期貨溢價率)"""

return (future_price - spot_price) / spot_price

def generate_signals(self, spot_data, future_data):

"""生成套利信號"""

# 確保數據對齊

combined_data = pd.DataFrame({

'spot_price': spot_data['close'],

'future_price': future_data['close'],

'timestamp': spot_data['timestamp']

})

# 計算基差

combined_data['basis'] = self.calculate_basis(

combined_data['spot_price'],

combined_data['future_price']

)

# 生成信號

combined_data['signal'] = 0

# 正向套利:期貨溢價過高

combined_data.loc[

combined_data['basis'] > self.entry_threshold,

'signal'

] = 1 # 買現貨,賣期貨

# 反向套利:期貨溢價過低(貼水)

combined_data.loc[

combined_data['basis'] < -self.entry_threshold,

'signal'

] = -1 # 賣現貨,買期貨

# 平倉信號

combined_data.loc[

abs(combined_data['basis']) < self.exit_threshold,

'signal'

] = 0

return combined_data

# 使用示例

arbitrage = SpotFutureArbitrage()

# 模擬數據

spot_data = pd.DataFrame({

'close': [50000, 50100, 50200, 50150, 50300],

'timestamp': pd.date_range('2024-01-01', periods=5, freq='1H')

})

future_data = pd.DataFrame({

'close': [50600, 50700, 50800, 50750, 50900], # 期貨溢價約 1.2%

'timestamp': pd.date_range('2024-01-01', periods=5, freq='1H')

})

signals = arbitrage.generate_signals(spot_data, future_data)

print(signals)

import websocket

import json

import threading

from queue import Queue

class CryptoDataCollector:

"""虛擬貨幣數據收集器"""

def __init__(self, symbols=['BTCUSDT', 'ETHUSDT']):

self.symbols = symbols

self.data_queue = Queue()

self.ws = None

def on_message(self, ws, message):

"""處理 WebSocket 消息"""

try:

data = json.loads(message)

self.data_queue.put(data)

except json.JSONDecodeError:

print(f"Invalid JSON: {message}")

def on_error(self, ws, error):

print(f"WebSocket error: {error}")

def on_close(self, ws, close_status_code, close_msg):

print("WebSocket connection closed")

def on_open(self, ws):

"""訂閱市場數據"""

subscribe_msg = {

"method": "SUBSCRIBE",

"params": [f"{symbol.lower()}@ticker" for symbol in self.symbols],

"id": 1

}

ws.send(json.dumps(subscribe_msg))

def start_collecting(self):

"""開始收集數據"""

websocket.enableTrace(True)

self.ws = websocket.WebSocketApp(

"wss://stream.binance.com:9443/ws/",

on_open=self.on_open,

on_message=self.on_message,

on_error=self.on_error,

on_close=self.on_close

)

# 在背景執行

thread = threading.Thread(target=self.ws.run_forever)

thread.daemon = True

thread.start()

def get_latest_data(self):

"""獲取最新數據"""

if not self.data_queue.empty():

return self.data_queue.get()

return None

class CryptoRiskManager:

"""虛擬貨幣風險管理系統"""

def __init__(self, max_position_size=0.1, max_drawdown=0.2):

self.max_position_size = max_position_size # 最大倉位 10%

self.max_drawdown = max_drawdown # 最大回撤 20%

self.current_positions = {}

self.portfolio_value = 100000 # 初始資金 10 萬

self.peak_value = 100000

def calculate_position_size(self, symbol, price, confidence):

"""計算倉位大小"""

# 基於信心度調整倉位

base_position = self.max_position_size * confidence

# 考慮虛擬貨幣的高波動性,降低倉位

volatility_adjustment = 0.5 # 50% 調整係數

adjusted_position = base_position * volatility_adjustment

# 計算具體數量

max_value = self.portfolio_value * adjusted_position

quantity = max_value / price

return quantity

def check_risk_limits(self, symbol, new_position):

"""檢查風險限制"""

# 檢查單一資產集中度

total_value = sum(pos['value'] for pos in self.current_positions.values())

if new_position['value'] / total_value > self.max_position_size:

return False, "超過單一資產最大倉位限制"

# 檢查總體回撤

current_drawdown = (self.peak_value - self.portfolio_value) / self.peak_value

if current_drawdown > self.max_drawdown:

return False, f"當前回撤 {current_drawdown:.2%} 超過限制 {self.max_drawdown:.2%}"

return True, "風險檢查通過"

def update_portfolio(self, symbol, price, quantity):

"""更新投資組合"""

value = price * quantity

self.current_positions[symbol] = {

'quantity': quantity,

'price': price,

'value': value

}

# 更新投資組合總值

self.portfolio_value = sum(pos['value'] for pos in self.current_positions.values())

# 更新峰值

if self.portfolio_value > self.peak_value:

self.peak_value = self.portfolio_value

虛擬貨幣市場相對年輕,存在操縱風險:

class MultiExchangeStrategy:

"""多交易所策略 - 降低單點風險"""

def __init__(self, exchanges=['binance', 'bybit', 'okx']):

self.exchanges = exchanges

self.connections = {}

def connect_all_exchanges(self):

"""連接所有交易所"""

for exchange in self.exchanges:

self.connections[exchange] = self.create_connection(exchange)

def get_best_price(self, symbol, side):

"""獲取最佳價格"""

prices = {}

for exchange in self.exchanges:

try:

price = self.connections[exchange].get_price(symbol, side)

prices[exchange] = price

except Exception as e:

print(f"{exchange} 價格獲取失敗: {e}")

if side == 'buy':

return min(prices.items(), key=lambda x: x[1]) # 最低買價

else:

return max(prices.items(), key=lambda x: x[1]) # 最高賣價

def staged_position_management(price_change, base_position):

"""階段式倉位管理 - 適應高波動性"""

if abs(price_change) < 0.05: # 5% 以內正常倉位

return base_position

elif abs(price_change) < 0.10: # 5-10% 減少一半倉位

return base_position * 0.5

elif abs(price_change) < 0.20: # 10-20% 大幅減少倉位

return base_position * 0.2

else: # 超過 20% 停止交易

return 0

今天我們深入探討了虛擬貨幣的量化交易特性,就像認識了一個全新的農業領域。虛擬貨幣市場的特點:

優勢:

挑戰:

成功關鍵:

明天我們將比較加密貨幣與傳統市場的差異,了解如何在這個新興市場中找到機會!

下一篇:Day 18 - 加密貨幣 vs 傳統市場