若N天後收盤價 > 目前收盤價,趨勢為正

若N天後收盤價 < 目前收盤價,趨勢為負

優點:

缺點:

若N天後收盤價 > 目前收盤價 + K%,趨勢為正

若N天後收盤價 < 目前收盤價 - K%,趨勢為負

中間值代表不漲不跌

優點:

缺點:

若N天最高點 > 目前收盤價 + K%,趨勢為正

若N天最低點 < 目前收盤價 - K%,趨勢為負

中間值代表不漲不跌

優點:

缺點:

若N天中某一天 > 目前收盤價 + K%,趨勢為正

若N天中某一天 < 目前收盤價 - K%,趨勢為負

優點:

缺點:

data_df = load_stock(stock_index, start_year=2011, end_year=2021)

shift = {}

for i in range(0, 31):

shift[i] = data_df.loc[:, "Close"].shift(-i)

close30_df = pd.DataFrame(shift).dropna()

Close_Low = close30_df.min(1)

Close_High = close30_df.max(1)

Close_Mean = close30_df.mean(1)

Close_Std = close30_df.std(1)

thresold = 3

tag = {}

for i in range(1, 31):

if i == 1:

up = close30_df[i] > close30_df[0] + thresold * Close_Std

down = close30_df[i] < close30_df[0] - thresold * Close_Std

tag[i] = 1 * up + (-1) * down

else:

up = close30_df[i] > close30_df[0] + thresold * Close_Std

down = close30_df[i] < close30_df[0] - thresold * Close_Std

tag[i] = np.clip(

(tag[i - 1] * 10) + (1 * up + (-1) * down), a_min=-1, a_max=1

)

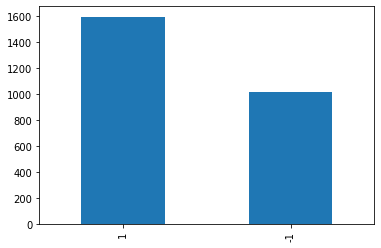

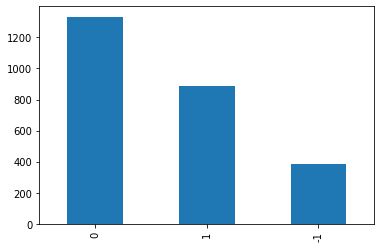

K = 1 std,對趨勢估計保守,傾向停利停損

K = 3 std,對趨勢估計激進,傾向高報酬