今天要學習對沖策略,這就像爸爸為農作物買保險一樣。還記得那年颱風來襲,隔壁叔叔因為沒保險血本無歸,而爸爸雖然產量受損,但保險理賠讓損失降到最低。對沖就是金融世界的保險策略!

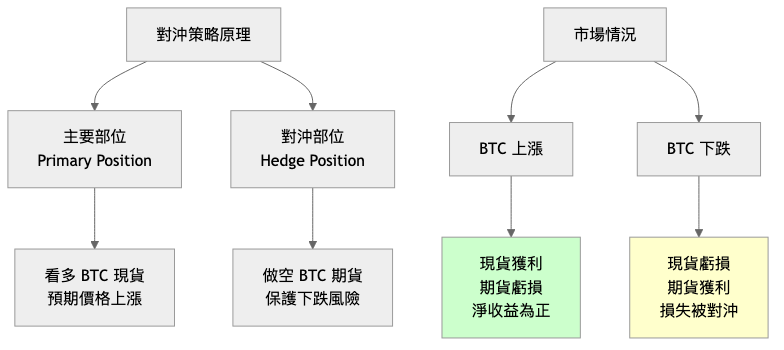

對沖是一種風險管理技術,通過建立相反的部位來減少投資組合的風險:

理論上完全消除風險的對沖:

class PerfectHedge:

"""完全對沖策略"""

def __init__(self, spot_position, hedge_ratio=1.0):

self.spot_position = spot_position # 現貨部位

self.hedge_ratio = hedge_ratio # 對沖比率

self.futures_position = -spot_position * hedge_ratio

def calculate_pnl(self, spot_price_change, futures_price_change):

"""計算對沖後的損益"""

spot_pnl = self.spot_position * spot_price_change

futures_pnl = self.futures_position * futures_price_change

total_pnl = spot_pnl + futures_pnl

return {

'spot_pnl': spot_pnl,

'futures_pnl': futures_pnl,

'total_pnl': total_pnl,

'hedge_effectiveness': 1 - abs(total_pnl) / abs(spot_pnl)

}

# 示例:完全對沖

hedge = PerfectHedge(spot_position=1.0) # 持有1 BTC現貨

# 情況1:BTC上漲10%

result1 = hedge.calculate_pnl(spot_price_change=0.1, futures_price_change=0.1)

print(f"BTC上漲10%時的對沖效果: {result1}")

# 情況2:BTC下跌15%

result2 = hedge.calculate_pnl(spot_price_change=-0.15, futures_price_change=-0.15)

print(f"BTC下跌15%時的對沖效果: {result2}")

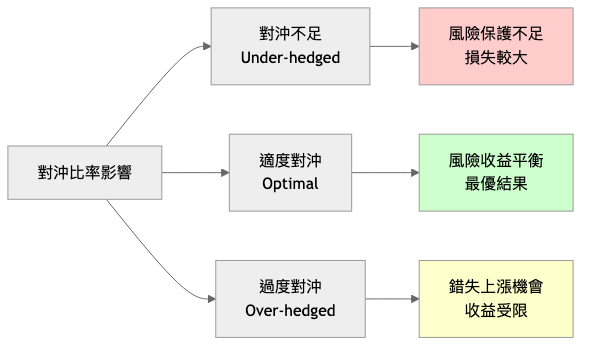

只對沖部分風險,保留一定的收益潛力:

class PartialHedge:

"""部分對沖策略"""

def __init__(self, spot_position, hedge_ratio=0.5):

self.spot_position = spot_position

self.hedge_ratio = hedge_ratio # 50%對沖

self.futures_position = -spot_position * hedge_ratio

self.net_exposure = spot_position * (1 - hedge_ratio)

def analyze_scenarios(self, price_changes):

"""分析不同價格變動情況"""

results = []

for change in price_changes:

spot_pnl = self.spot_position * change

futures_pnl = self.futures_position * change

total_pnl = spot_pnl + futures_pnl

results.append({

'price_change': f"{change:.1%}",

'unhedged_pnl': spot_pnl,

'hedged_pnl': total_pnl,

'protection_rate': (spot_pnl - total_pnl) / spot_pnl if spot_pnl != 0 else 0

})

return results

# 分析部分對沖效果

partial_hedge = PartialHedge(spot_position=10) # 持有10個單位

scenarios = partial_hedge.analyze_scenarios([-0.3, -0.2, -0.1, 0, 0.1, 0.2, 0.3])

for scenario in scenarios:

print(f"價格變動 {scenario['price_change']}: "

f"無對沖損益 {scenario['unhedged_pnl']:.2f}, "

f"對沖後損益 {scenario['hedged_pnl']:.2f}")

根據市場條件調整對沖比率:

class DynamicHedge:

"""動態對沖策略"""

def __init__(self, spot_position):

self.spot_position = spot_position

self.current_hedge_ratio = 0

self.hedge_history = []

def calculate_optimal_hedge_ratio(self, volatility, correlation, risk_tolerance):

"""計算最優對沖比率"""

# 基於波動性和相關性的動態調整

base_ratio = min(volatility * 2, 1.0) # 波動性越高,對沖比率越高

# 風險承受度調整

risk_adjustment = 1 - risk_tolerance # 風險承受度低,對沖比率高

optimal_ratio = base_ratio * risk_adjustment

return min(optimal_ratio, 1.0)

def update_hedge(self, market_data):

"""更新對沖比率"""

volatility = market_data['volatility']

correlation = market_data['correlation']

risk_tolerance = market_data['risk_tolerance']

new_ratio = self.calculate_optimal_hedge_ratio(

volatility, correlation, risk_tolerance

)

# 記錄調整

self.hedge_history.append({

'timestamp': market_data['timestamp'],

'old_ratio': self.current_hedge_ratio,

'new_ratio': new_ratio,

'reason': self.get_adjustment_reason(new_ratio)

})

self.current_hedge_ratio = new_ratio

return new_ratio

def get_adjustment_reason(self, new_ratio):

"""獲取調整原因"""

if new_ratio > self.current_hedge_ratio:

return "增加對沖:市場風險上升"

elif new_ratio < self.current_hedge_ratio:

return "減少對沖:市場趨勢明確"

else:

return "維持對沖:市場狀況穩定"

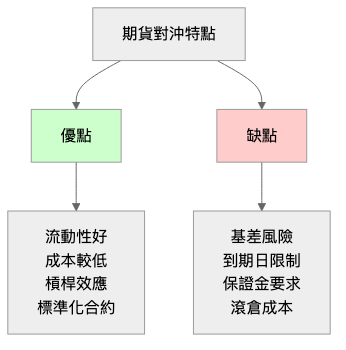

class FuturesHedge:

"""期貨對沖策略"""

def __init__(self, spot_position, contract_size=1):

self.spot_position = spot_position

self.contract_size = contract_size

self.contracts_needed = spot_position / contract_size

def calculate_basis_risk(self, spot_price, futures_price):

"""計算基差風險"""

basis = futures_price - spot_price

basis_risk = abs(basis) / spot_price

return basis, basis_risk

def hedge_effectiveness(self, spot_returns, futures_returns):

"""計算對沖有效性"""

import numpy as np

# 計算對沖組合收益

hedge_returns = spot_returns - futures_returns

# 對沖有效性 = 1 - (對沖後方差 / 原始方差)

original_variance = np.var(spot_returns)

hedged_variance = np.var(hedge_returns)

effectiveness = 1 - (hedged_variance / original_variance)

return effectiveness

保護性看跌期權(Protective Put):

class ProtectivePut:

"""保護性看跌期權策略"""

def __init__(self, spot_position, strike_price, option_premium):

self.spot_position = spot_position

self.strike_price = strike_price

self.option_premium = option_premium

def calculate_payoff(self, spot_price_at_expiry):

"""計算到期損益"""

# 現貨損益

spot_pnl = self.spot_position * (spot_price_at_expiry - self.strike_price)

# 選擇權損益

option_pnl = max(self.strike_price - spot_price_at_expiry, 0) * self.spot_position

# 減去選擇權權利金

total_pnl = spot_pnl + option_pnl - self.option_premium

return {

'spot_pnl': spot_pnl,

'option_pnl': option_pnl,

'premium_cost': -self.option_premium,

'total_pnl': total_pnl,

'protected': spot_price_at_expiry < self.strike_price

}

def analyze_strategy(self, price_range):

"""分析策略在不同價格下的表現"""

results = []

for price in price_range:

payoff = self.calculate_payoff(price)

results.append({

'price': price,

'total_pnl': payoff['total_pnl'],

'protected': payoff['protected']

})

return results

# 示例:保護性看跌期權

protective_put = ProtectivePut(

spot_position=1, # 持有1個單位

strike_price=50000, # 履約價50,000

option_premium=2000 # 權利金2,000

)

# 分析不同價格情況

price_range = [40000, 45000, 50000, 55000, 60000]

results = protective_put.analyze_strategy(price_range)

for result in results:

protection_status = "受保護" if result['protected'] else "未受保護"

print(f"價格 {result['price']}: 損益 {result['total_pnl']:.0f} ({protection_status})")

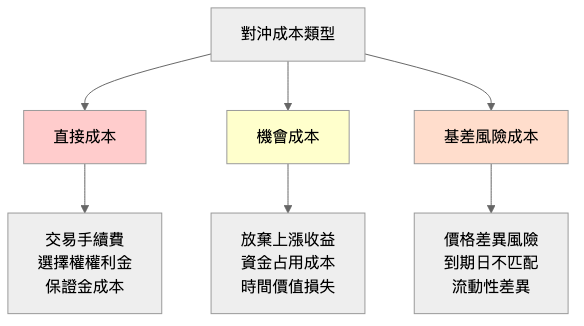

class HedgeCostBenefitAnalysis:

"""對沖成本效益分析"""

def __init__(self, portfolio_value):

self.portfolio_value = portfolio_value

self.costs = {

'transaction_costs': 0.001, # 0.1%交易成本

'option_premium': 0.02, # 2%選擇權權利金

'opportunity_cost': 0.05, # 5%機會成本

'basis_risk': 0.005 # 0.5%基差風險

}

def calculate_total_hedging_cost(self, hedge_ratio, time_period):

"""計算總對沖成本"""

hedged_amount = self.portfolio_value * hedge_ratio

# 直接成本

transaction_cost = hedged_amount * self.costs['transaction_costs']

premium_cost = hedged_amount * self.costs['option_premium']

# 時間相關成本

opportunity_cost = hedged_amount * self.costs['opportunity_cost'] * time_period

basis_risk_cost = hedged_amount * self.costs['basis_risk'] * time_period

total_cost = transaction_cost + premium_cost + opportunity_cost + basis_risk_cost

return {

'transaction_cost': transaction_cost,

'premium_cost': premium_cost,

'opportunity_cost': opportunity_cost,

'basis_risk_cost': basis_risk_cost,

'total_cost': total_cost,

'cost_percentage': total_cost / self.portfolio_value

}

def hedge_efficiency_ratio(self, risk_reduction, total_cost):

"""計算對沖效率比率"""

return risk_reduction / total_cost

# 成本效益分析示例

analyzer = HedgeCostBenefitAnalysis(portfolio_value=100000)

# 分析不同對沖比率的成本

hedge_ratios = [0.25, 0.5, 0.75, 1.0]

time_period = 0.25 # 3個月

for ratio in hedge_ratios:

cost_analysis = analyzer.calculate_total_hedging_cost(ratio, time_period)

print(f"對沖比率 {ratio:.0%}: 總成本 ${cost_analysis['total_cost']:.0f} "

f"({cost_analysis['cost_percentage']:.2%})")

現貨和期貨價格差異變動的風險:

def analyze_basis_risk(spot_prices, futures_prices):

"""分析基差風險"""

import numpy as np

basis = futures_prices - spot_prices

basis_volatility = np.std(basis)

basis_mean = np.mean(basis)

# 基差風險指標

basis_risk_metrics = {

'basis_volatility': basis_volatility,

'basis_mean': basis_mean,

'basis_range': [np.min(basis), np.max(basis)],

'basis_stability': 1 - (basis_volatility / abs(basis_mean)) if basis_mean != 0 else 0

}

return basis_risk_metrics

對沖比率過高導致的風險:

class CryptoPortfolioHedge:

"""加密貨幣投資組合對沖"""

def __init__(self, portfolio):

self.portfolio = portfolio # {'BTC': 2, 'ETH': 10, 'USDT': 50000}

self.hedge_positions = {}

def calculate_portfolio_beta(self, market_returns, portfolio_returns):

"""計算投資組合相對於市場的貝塔值"""

import numpy as np

covariance = np.cov(portfolio_returns, market_returns)[0][1]

market_variance = np.var(market_returns)

beta = covariance / market_variance

return beta

def implement_beta_hedge(self, beta, market_index_price):

"""實施貝塔對沖"""

# 計算投資組合總值

portfolio_value = self.calculate_portfolio_value()

# 計算對沖數量

hedge_amount = portfolio_value * beta

# 建立對沖部位(做空市場指數)

self.hedge_positions['market_hedge'] = {

'type': 'short',

'amount': hedge_amount,

'price': market_index_price,

'purpose': 'beta_hedge'

}

return hedge_amount

def calculate_portfolio_value(self):

"""計算投資組合總值(簡化)"""

# 簡化計算,實際應該獲取實時價格

return 100000 # 假設總值10萬

def rebalance_hedge(self, new_beta):

"""重新平衡對沖比率"""

current_hedge = self.hedge_positions.get('market_hedge', {}).get('amount', 0)

portfolio_value = self.calculate_portfolio_value()

target_hedge = portfolio_value * new_beta

adjustment = target_hedge - current_hedge

return {

'current_hedge': current_hedge,

'target_hedge': target_hedge,

'adjustment_needed': adjustment,

'action': 'increase_hedge' if adjustment > 0 else 'decrease_hedge'

}

class HedgePerformanceMetrics:

"""對沖策略績效指標"""

def __init__(self, unhedged_returns, hedged_returns):

self.unhedged_returns = unhedged_returns

self.hedged_returns = hedged_returns

def calculate_hedge_effectiveness(self):

"""計算對沖有效性"""

import numpy as np

unhedged_volatility = np.std(self.unhedged_returns)

hedged_volatility = np.std(self.hedged_returns)

variance_reduction = 1 - (hedged_volatility ** 2) / (unhedged_volatility ** 2)

return variance_reduction

def calculate_downside_protection(self):

"""計算下行保護效果"""

import numpy as np

unhedged_downside = np.mean([r for r in self.unhedged_returns if r < 0])

hedged_downside = np.mean([r for r in self.hedged_returns if r < 0])

if unhedged_downside == 0:

return 0

protection_ratio = 1 - abs(hedged_downside) / abs(unhedged_downside)

return protection_ratio

def calculate_upside_capture(self):

"""計算上行捕獲率"""

import numpy as np

unhedged_upside = np.mean([r for r in self.unhedged_returns if r > 0])

hedged_upside = np.mean([r for r in self.hedged_returns if r > 0])

if unhedged_upside == 0:

return 0

capture_ratio = hedged_upside / unhedged_upside

return capture_ratio

今天我們深入探討了對沖策略,就像學會了為農作物買保險的各種方法。對沖的關鍵要點:

對沖的價值:

對沖的成本:

成功對沖的關鍵:

實戰建議:

明天我們將探討虛擬貨幣中的現貨與期貨,了解這兩種工具的特性和應用!

下一篇:Day 20 - 虛擬貨幣中的現貨與期貨