今天要學習 Paper Trade(模擬交易),這就像爸爸在決定種新作物前,先在小塊試驗田做實驗一樣。在真正投入資金之前,我們需要在安全的環境中驗證策略,累積經驗,就像先用假錢練習,等熟練了再用真錢!

Paper Trade 是使用虛擬資金進行的模擬交易:

import pandas as pd

import numpy as np

from datetime import datetime, timedelta

from typing import Dict, List, Optional

import uuid

class PaperTrade:

"""模擬交易系統"""

def __init__(self, initial_balance=100000):

self.initial_balance = initial_balance

self.balance = initial_balance

self.positions = {} # {symbol: {'side', 'size', 'entry_price', 'entry_time'}}

self.orders = {} # {order_id: order_info}

self.trade_history = []

self.pnl_history = []

self.market_data = {}

def add_market_data(self, symbol, data):

"""添加市場數據"""

self.market_data[symbol] = data

def get_current_price(self, symbol, timestamp=None):

"""獲取當前價格"""

if symbol not in self.market_data:

raise ValueError(f"No market data for {symbol}")

if timestamp is None:

return self.market_data[symbol]['close'].iloc[-1]

# 根據時間戳獲取歷史價格

data = self.market_data[symbol]

try:

return data.loc[data.index <= timestamp, 'close'].iloc[-1]

except IndexError:

return data['close'].iloc[0]

def place_order(self, symbol, side, size, order_type='market', price=None):

"""下單"""

order_id = str(uuid.uuid4())

timestamp = datetime.now()

order = {

'order_id': order_id,

'symbol': symbol,

'side': side, # 'buy' or 'sell'

'size': size,

'order_type': order_type,

'price': price,

'timestamp': timestamp,

'status': 'pending'

}

self.orders[order_id] = order

# 立即執行市價單

if order_type == 'market':

return self.execute_order(order_id)

return order_id

def execute_order(self, order_id):

"""執行訂單"""

if order_id not in self.orders:

return False, "Order not found"

order = self.orders[order_id]

symbol = order['symbol']

side = order['side']

size = order['size']

try:

# 獲取執行價格

if order['order_type'] == 'market':

execution_price = self.get_current_price(symbol)

else:

execution_price = order['price']

# 檢查餘額是否足夠

if side == 'buy':

required_balance = size * execution_price

if required_balance > self.balance:

order['status'] = 'rejected'

return False, "Insufficient balance"

# 更新持倉

self._update_position(symbol, side, size, execution_price, order['timestamp'])

# 更新餘額

if side == 'buy':

self.balance -= size * execution_price

else:

self.balance += size * execution_price

# 記錄交易

trade = {

'trade_id': str(uuid.uuid4()),

'order_id': order_id,

'symbol': symbol,

'side': side,

'size': size,

'price': execution_price,

'timestamp': order['timestamp'],

'pnl': self._calculate_trade_pnl(symbol, side, size, execution_price)

}

self.trade_history.append(trade)

order['status'] = 'filled'

order['execution_price'] = execution_price

return True, f"Order executed: {side} {size} {symbol} at {execution_price}"

except Exception as e:

order['status'] = 'error'

return False, f"Execution error: {str(e)}"

def _update_position(self, symbol, side, size, price, timestamp):

"""更新持倉"""

if symbol not in self.positions:

self.positions[symbol] = {

'side': side,

'size': size,

'entry_price': price,

'entry_time': timestamp

}

else:

position = self.positions[symbol]

if position['side'] == side:

# 加倉

total_size = position['size'] + size

weighted_price = (position['size'] * position['entry_price'] +

size * price) / total_size

position['size'] = total_size

position['entry_price'] = weighted_price

else:

# 反向交易

if size >= position['size']:

# 完全平倉或反向

remaining_size = size - position['size']

if remaining_size > 0:

position['side'] = side

position['size'] = remaining_size

position['entry_price'] = price

position['entry_time'] = timestamp

else:

del self.positions[symbol]

else:

# 部分平倉

position['size'] -= size

def _calculate_trade_pnl(self, symbol, side, size, price):

"""計算交易損益"""

if symbol not in self.positions:

return 0

position = self.positions[symbol]

if position['side'] != side:

# 平倉交易

if side == 'sell':

return size * (price - position['entry_price'])

else:

return size * (position['entry_price'] - price)

return 0 # 開倉交易無立即損益

def calculate_portfolio_value(self):

"""計算投資組合總值"""

total_value = self.balance

for symbol, position in self.positions.items():

try:

current_price = self.get_current_price(symbol)

position_value = position['size'] * current_price

if position['side'] == 'buy':

total_value += position_value

else:

# 做空倉位的價值計算

entry_value = position['size'] * position['entry_price']

pnl = position['size'] * (position['entry_price'] - current_price)

total_value += entry_value + pnl

except Exception:

continue

return total_value

def get_unrealized_pnl(self):

"""計算未實現損益"""

unrealized_pnl = {}

total_unrealized = 0

for symbol, position in self.positions.items():

try:

current_price = self.get_current_price(symbol)

if position['side'] == 'buy':

pnl = position['size'] * (current_price - position['entry_price'])

else:

pnl = position['size'] * (position['entry_price'] - current_price)

unrealized_pnl[symbol] = {

'position': position,

'current_price': current_price,

'unrealized_pnl': pnl,

'pnl_percentage': pnl / (position['size'] * position['entry_price'])

}

total_unrealized += pnl

except Exception:

continue

return unrealized_pnl, total_unrealized

def get_performance_metrics(self):

"""計算績效指標"""

if not self.trade_history:

return {}

trades = pd.DataFrame(self.trade_history)

# 計算總收益

total_pnl = trades['pnl'].sum()

# 計算勝率

winning_trades = trades[trades['pnl'] > 0]

losing_trades = trades[trades['pnl'] < 0]

win_rate = len(winning_trades) / len(trades) if len(trades) > 0 else 0

# 計算平均盈虧

avg_win = winning_trades['pnl'].mean() if len(winning_trades) > 0 else 0

avg_loss = losing_trades['pnl'].mean() if len(losing_trades) > 0 else 0

# 計算收益率

portfolio_value = self.calculate_portfolio_value()

total_return = (portfolio_value - self.initial_balance) / self.initial_balance

return {

'total_trades': len(trades),

'winning_trades': len(winning_trades),

'losing_trades': len(losing_trades),

'win_rate': win_rate,

'total_pnl': total_pnl,

'avg_win': avg_win,

'avg_loss': avg_loss,

'profit_factor': abs(avg_win / avg_loss) if avg_loss != 0 else float('inf'),

'initial_balance': self.initial_balance,

'current_balance': self.balance,

'portfolio_value': portfolio_value,

'total_return': total_return

}

class MAStrategy:

"""移動平均策略 - Paper Trade 版本"""

def __init__(self, paper_trader, fast_period=20, slow_period=50):

self.paper_trader = paper_trader

self.fast_period = fast_period

self.slow_period = slow_period

self.last_signal = None

def calculate_signals(self, symbol, data):

"""計算交易信號"""

# 計算移動平均

data['fast_ma'] = data['close'].rolling(self.fast_period).mean()

data['slow_ma'] = data['close'].rolling(self.slow_period).mean()

# 生成信號

data['signal'] = 0

data.loc[data['fast_ma'] > data['slow_ma'], 'signal'] = 1 # 買入信號

data.loc[data['fast_ma'] < data['slow_ma'], 'signal'] = -1 # 賣出信號

return data

def execute_strategy(self, symbol, current_data):

"""執行策略"""

# 計算當前信號

signals = self.calculate_signals(symbol, current_data)

current_signal = signals['signal'].iloc[-1]

# 如果信號改變,執行交易

if current_signal != self.last_signal:

# 檢查當前持倉

current_position = self.paper_trader.positions.get(symbol)

if current_signal == 1: # 買入信號

if current_position is None or current_position['side'] == 'sell':

# 平掉空倉(如果有的話)

if current_position and current_position['side'] == 'sell':

self.paper_trader.place_order(

symbol, 'buy', current_position['size']

)

# 開多倉

trade_size = self.calculate_position_size(symbol)

self.paper_trader.place_order(symbol, 'buy', trade_size)

elif current_signal == -1: # 賣出信號

if current_position is None or current_position['side'] == 'buy':

# 平掉多倉(如果有的話)

if current_position and current_position['side'] == 'buy':

self.paper_trader.place_order(

symbol, 'sell', current_position['size']

)

# 開空倉

trade_size = self.calculate_position_size(symbol)

self.paper_trader.place_order(symbol, 'sell', trade_size)

self.last_signal = current_signal

def calculate_position_size(self, symbol):

"""計算倉位大小"""

# 簡單的固定比例倉位管理

current_price = self.paper_trader.get_current_price(symbol)

max_position_value = self.paper_trader.balance * 0.2 # 最大20%倉位

return max_position_value / current_price

# 策略回測示例

def run_strategy_simulation():

"""運行策略模擬"""

# 創建模擬交易器

paper_trader = PaperTrade(initial_balance=100000)

# 生成模擬數據

dates = pd.date_range('2024-01-01', '2024-12-31', freq='1D')

np.random.seed(42)

# 模擬 BTC 價格數據

returns = np.random.normal(0.001, 0.03, len(dates)) # 平均日收益0.1%,波動3%

prices = [50000] # 起始價格

for r in returns[1:]:

prices.append(prices[-1] * (1 + r))

btc_data = pd.DataFrame({

'close': prices,

'timestamp': dates

}, index=dates)

paper_trader.add_market_data('BTC', btc_data)

# 創建策略

strategy = MAStrategy(paper_trader)

# 執行回測

for i in range(50, len(btc_data)): # 從第50天開始(確保有足夠數據計算移動平均)

current_data = btc_data.iloc[:i+1]

strategy.execute_strategy('BTC', current_data)

# 獲取績效報告

metrics = paper_trader.get_performance_metrics()

print("模擬交易績效報告:")

print(f"總交易次數: {metrics['total_trades']}")

print(f"勝率: {metrics['win_rate']:.2%}")

print(f"總損益: ${metrics['total_pnl']:.2f}")

print(f"總收益率: {metrics['total_return']:.2%}")

print(f"盈虧比: {metrics['profit_factor']:.2f}")

return paper_trader, metrics

# 執行模擬

trader, results = run_strategy_simulation()

class RealisticPaperTrade(PaperTrade):

"""更真實的模擬交易系統"""

def __init__(self, initial_balance=100000, commission_rate=0.001, slippage_rate=0.0005):

super().__init__(initial_balance)

self.commission_rate = commission_rate

self.slippage_rate = slippage_rate

self.max_order_size_ratio = 0.1 # 最大單筆訂單佔市場成交量比例

def simulate_slippage(self, symbol, side, size, theoretical_price):

"""模擬滑價"""

# 根據訂單大小和方向計算滑價

market_impact = size * 0.00001 # 簡化的市場衝擊模型

if side == 'buy':

slippage = theoretical_price * (self.slippage_rate + market_impact)

execution_price = theoretical_price + slippage

else:

slippage = theoretical_price * (self.slippage_rate + market_impact)

execution_price = theoretical_price - slippage

return execution_price, slippage

def calculate_commission(self, symbol, size, price):

"""計算手續費"""

notional_value = size * price

commission = notional_value * self.commission_rate

return commission

def execute_order(self, order_id):

"""重寫訂單執行,加入現實因子"""

if order_id not in self.orders:

return False, "Order not found"

order = self.orders[order_id]

symbol = order['symbol']

side = order['side']

size = order['size']

try:

# 獲取理論執行價格

theoretical_price = self.get_current_price(symbol)

# 模擬滑價

execution_price, slippage = self.simulate_slippage(

symbol, side, size, theoretical_price

)

# 計算手續費

commission = self.calculate_commission(symbol, size, execution_price)

# 檢查餘額(包含手續費)

if side == 'buy':

required_balance = size * execution_price + commission

if required_balance > self.balance:

order['status'] = 'rejected'

return False, "Insufficient balance including commission"

# 執行交易

self._update_position(symbol, side, size, execution_price, order['timestamp'])

# 更新餘額(扣除手續費)

if side == 'buy':

self.balance -= (size * execution_price + commission)

else:

self.balance += (size * execution_price - commission)

# 記錄詳細交易資訊

trade = {

'trade_id': str(uuid.uuid4()),

'order_id': order_id,

'symbol': symbol,

'side': side,

'size': size,

'theoretical_price': theoretical_price,

'execution_price': execution_price,

'slippage': slippage,

'commission': commission,

'timestamp': order['timestamp'],

'pnl': self._calculate_trade_pnl(symbol, side, size, execution_price)

}

self.trade_history.append(trade)

order['status'] = 'filled'

order['execution_price'] = execution_price

order['slippage'] = slippage

order['commission'] = commission

return True, f"Order executed with slippage: {side} {size} {symbol} at {execution_price:.2f} (slippage: {slippage:.2f})"

except Exception as e:

order['status'] = 'error'

return False, f"Execution error: {str(e)}"

def get_detailed_performance_metrics(self):

"""獲取包含現實因子的詳細績效指標"""

base_metrics = self.get_performance_metrics()

if not self.trade_history:

return base_metrics

trades = pd.DataFrame(self.trade_history)

# 計算成本分析

total_commission = trades['commission'].sum()

total_slippage = trades['slippage'].sum()

total_trading_costs = total_commission + total_slippage

# 計算成本對績效的影響

gross_pnl = trades['pnl'].sum() + total_trading_costs

net_pnl = trades['pnl'].sum()

cost_impact = total_trading_costs / abs(gross_pnl) if gross_pnl != 0 else 0

base_metrics.update({

'total_commission': total_commission,

'total_slippage': total_slippage,

'total_trading_costs': total_trading_costs,

'gross_pnl': gross_pnl,

'net_pnl': net_pnl,

'cost_impact_percentage': cost_impact,

'average_commission_per_trade': total_commission / len(trades),

'average_slippage_per_trade': total_slippage / len(trades)

})

return base_metrics

# 現實模擬示例

realistic_trader = RealisticPaperTrade(

initial_balance=100000,

commission_rate=0.001, # 0.1% 手續費

slippage_rate=0.0005 # 0.05% 滑價

)

class ComprehensivePaperTrade:

"""綜合模擬交易環境"""

def __init__(self):

self.trading_hours = {

'crypto': {'start': 0, 'end': 24}, # 24/7

'forex': {'start': 0, 'end': 24}, # 週日晚到週五晚

'stocks': {'start': 9.5, 'end': 16} # 9:30-16:00

}

self.market_conditions = {

'normal': {'volatility_multiplier': 1.0, 'liquidity_multiplier': 1.0},

'high_volatility': {'volatility_multiplier': 2.0, 'liquidity_multiplier': 0.7},

'low_liquidity': {'volatility_multiplier': 1.2, 'liquidity_multiplier': 0.3},

'market_crash': {'volatility_multiplier': 5.0, 'liquidity_multiplier': 0.1}

}

def simulate_market_conditions(self, base_data, condition='normal'):

"""模擬不同市場條件"""

condition_params = self.market_conditions[condition]

volatility_mult = condition_params['volatility_multiplier']

liquidity_mult = condition_params['liquidity_multiplier']

# 調整價格波動

returns = base_data['close'].pct_change()

adjusted_returns = returns * volatility_mult

# 重新計算價格

adjusted_prices = [base_data['close'].iloc[0]]

for ret in adjusted_returns[1:]:

if not np.isnan(ret):

adjusted_prices.append(adjusted_prices[-1] * (1 + ret))

else:

adjusted_prices.append(adjusted_prices[-1])

# 調整流動性(影響滑價)

adjusted_data = base_data.copy()

adjusted_data['close'] = adjusted_prices

adjusted_data['liquidity_multiplier'] = liquidity_mult

return adjusted_data

def validate_strategy_robustness(self, strategy, test_scenarios):

"""測試策略在不同場景下的穩健性"""

results = {}

for scenario_name, scenario_data in test_scenarios.items():

# 為每個場景創建新的模擬交易器

trader = RealisticPaperTrade()

# 運行策略

strategy_instance = MAStrategy(trader)

for i in range(50, len(scenario_data)):

current_data = scenario_data.iloc[:i+1]

strategy_instance.execute_strategy('BTC', current_data)

# 記錄結果

metrics = trader.get_detailed_performance_metrics()

results[scenario_name] = metrics

return results

# 多場景測試

def comprehensive_strategy_test():

"""綜合策略測試"""

simulator = ComprehensivePaperTrade()

# 創建基礎數據

dates = pd.date_range('2024-01-01', '2024-12-31', freq='1D')

np.random.seed(42)

base_returns = np.random.normal(0.001, 0.02, len(dates))

base_prices = [50000]

for r in base_returns[1:]:

base_prices.append(base_prices[-1] * (1 + r))

base_data = pd.DataFrame({

'close': base_prices,

'timestamp': dates

}, index=dates)

# 創建不同市場場景

test_scenarios = {

'normal_market': simulator.simulate_market_conditions(base_data, 'normal'),

'high_volatility': simulator.simulate_market_conditions(base_data, 'high_volatility'),

'low_liquidity': simulator.simulate_market_conditions(base_data, 'low_liquidity'),

'market_crash': simulator.simulate_market_conditions(base_data, 'market_crash')

}

# 測試策略穩健性

results = simulator.validate_strategy_robustness(MAStrategy, test_scenarios)

# 分析結果

print("策略穩健性測試結果:")

print("-" * 50)

for scenario, metrics in results.items():

print(f"\n{scenario.upper()}:")

print(f"總收益率: {metrics.get('total_return', 0):.2%}")

print(f"勝率: {metrics.get('win_rate', 0):.2%}")

print(f"最大回撤: {metrics.get('max_drawdown', 0):.2%}")

print(f"交易成本影響: {metrics.get('cost_impact_percentage', 0):.2%}")

return results

# 執行測試

test_results = comprehensive_strategy_test()

class PsychologicalPaperTrade(RealisticPaperTrade):

"""包含心理因素的模擬交易"""

def __init__(self, initial_balance=100000):

super().__init__(initial_balance)

self.emotional_state = 'neutral' # 'confident', 'fearful', 'greedy', 'neutral'

self.consecutive_losses = 0

self.consecutive_wins = 0

self.stress_level = 0 # 0-10

def update_emotional_state(self):

"""更新情緒狀態"""

if self.consecutive_losses >= 3:

self.emotional_state = 'fearful'

self.stress_level = min(10, self.stress_level + 2)

elif self.consecutive_wins >= 3:

self.emotional_state = 'greedy'

self.stress_level = max(0, self.stress_level - 1)

else:

self.emotional_state = 'neutral'

self.stress_level = max(0, self.stress_level - 0.5)

def emotional_adjustment(self, original_size):

"""根據情緒狀態調整倉位大小"""

if self.emotional_state == 'fearful':

return original_size * 0.5 # 恐懼時減少倉位

elif self.emotional_state == 'greedy':

return original_size * 1.5 # 貪婪時增加倉位

else:

return original_size

def execute_order_with_emotion(self, order_id):

"""執行帶有情緒影響的訂單"""

if order_id not in self.orders:

return False, "Order not found"

order = self.orders[order_id]

# 情緒影響訂單執行

if self.emotional_state == 'fearful' and np.random.random() < 0.3:

order['status'] = 'cancelled'

return False, "Order cancelled due to fear"

# 調整訂單大小

original_size = order['size']

adjusted_size = self.emotional_adjustment(original_size)

order['size'] = adjusted_size

# 執行訂單

result = super().execute_order(order_id)

# 更新連續盈虧記錄

if result[0]: # 如果成功執行

trade = self.trade_history[-1]

if trade['pnl'] > 0:

self.consecutive_wins += 1

self.consecutive_losses = 0

elif trade['pnl'] < 0:

self.consecutive_losses += 1

self.consecutive_wins = 0

self.update_emotional_state()

return result

class PerformanceAnalyzer:

"""績效分析器"""

def __init__(self, paper_trader):

self.trader = paper_trader

def generate_comprehensive_report(self):

"""生成綜合報告"""

metrics = self.trader.get_detailed_performance_metrics()

report = {

'basic_metrics': self._analyze_basic_metrics(metrics),

'risk_metrics': self._analyze_risk_metrics(),

'trade_analysis': self._analyze_trades(),

'recommendations': self._generate_recommendations(metrics)

}

return report

def _analyze_basic_metrics(self, metrics):

"""分析基本指標"""

return {

'total_return': metrics.get('total_return', 0),

'win_rate': metrics.get('win_rate', 0),

'profit_factor': metrics.get('profit_factor', 0),

'average_trade': metrics.get('total_pnl', 0) / max(metrics.get('total_trades', 1), 1),

'trading_frequency': metrics.get('total_trades', 0) / 365 # 假設一年數據

}

def _analyze_risk_metrics(self):

"""分析風險指標"""

if not self.trader.trade_history:

return {}

trades = pd.DataFrame(self.trader.trade_history)

daily_pnl = trades.groupby(trades['timestamp'].dt.date)['pnl'].sum()

# 計算夏普比率

if len(daily_pnl) > 1:

sharpe_ratio = daily_pnl.mean() / daily_pnl.std() * np.sqrt(252)

else:

sharpe_ratio = 0

# 計算最大回撤

cumulative_pnl = daily_pnl.cumsum()

peak = cumulative_pnl.expanding().max()

drawdown = (cumulative_pnl - peak) / peak

max_drawdown = drawdown.min()

return {

'sharpe_ratio': sharpe_ratio,

'max_drawdown': max_drawdown,

'volatility': daily_pnl.std() * np.sqrt(252),

'downside_deviation': daily_pnl[daily_pnl < 0].std() * np.sqrt(252)

}

def _analyze_trades(self):

"""分析交易模式"""

if not self.trader.trade_history:

return {}

trades = pd.DataFrame(self.trader.trade_history)

# 分析交易時間分佈

trades['hour'] = trades['timestamp'].dt.hour

hourly_pnl = trades.groupby('hour')['pnl'].sum()

# 分析持倉時間(需要配對買賣訂單)

# 這裡簡化處理

return {

'best_trading_hours': hourly_pnl.idxmax(),

'worst_trading_hours': hourly_pnl.idxmin(),

'total_commission_paid': trades['commission'].sum() if 'commission' in trades else 0,

'total_slippage_cost': trades['slippage'].sum() if 'slippage' in trades else 0

}

def _generate_recommendations(self, metrics):

"""生成改進建議"""

recommendations = []

if metrics.get('win_rate', 0) < 0.4:

recommendations.append("勝率偏低,考慮優化進場信號")

if metrics.get('profit_factor', 0) < 1.5:

recommendations.append("盈虧比需要改善,考慮調整停損停利設定")

if metrics.get('cost_impact_percentage', 0) > 0.3:

recommendations.append("交易成本過高,考慮降低交易頻率")

if not recommendations:

recommendations.append("策略表現良好,可考慮小額實盤測試")

return recommendations

# 生成完整報告

def generate_paper_trade_report(trader):

"""生成完整的模擬交易報告"""

analyzer = PerformanceAnalyzer(trader)

report = analyzer.generate_comprehensive_report()

print("=" * 60)

print("模擬交易完整報告")

print("=" * 60)

print("\n基本指標:")

for key, value in report['basic_metrics'].items():

print(f"{key}: {value:.4f}")

print("\n風險指標:")

for key, value in report['risk_metrics'].items():

print(f"{key}: {value:.4f}")

print("\n交易分析:")

for key, value in report['trade_analysis'].items():

print(f"{key}: {value}")

print("\n改進建議:")

for i, rec in enumerate(report['recommendations'], 1):

print(f"{i}. {rec}")

return report

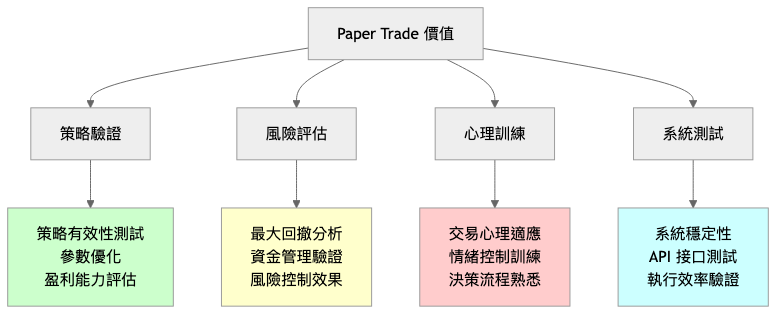

今天我們深入學習了 Paper Trade(模擬交易),就像在試驗田裡先測試新品種一樣。模擬交易的重要價值:

Paper Trade 的優勢:

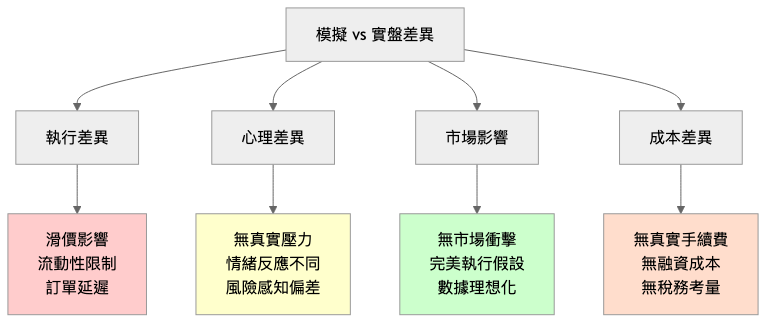

關鍵注意事項:

最佳實踐:

從模擬到實盤的過渡:

Paper Trade 就像農夫的試驗田,是通往成功交易的必經之路。明天我們將開始實作部分,把理論和模擬轉化為真正的交易系統!

下一篇:Day 26 - 範例實作說明