[魔法陣系列] Recurrent Neural Network(RNN)之術式解析 中介紹了:

本篇文章要帶各位見習魔法使搭建一個 LSTM 的神經網絡,與 CNN 的實戰系列一樣,採用 Keras 作為實作的工具。

預測股票趨勢(上漲/下跌)

Keras 2.1.5

Python 3.6.4

# Import the libraries

import numpy as np

import matplotlib.pyplot as plt # for 畫圖用

import pandas as pd

# Import the training set

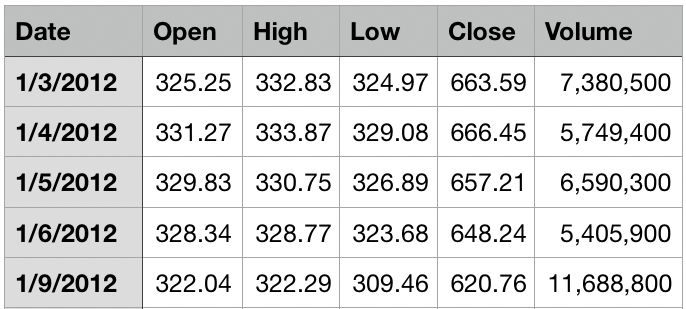

dataset_train = pd.read_csv('Google_Stock_Price_Train.csv') # 讀取訓練集

training_set = dataset_train.iloc[:, 1:2].values # 取「Open」欄位值

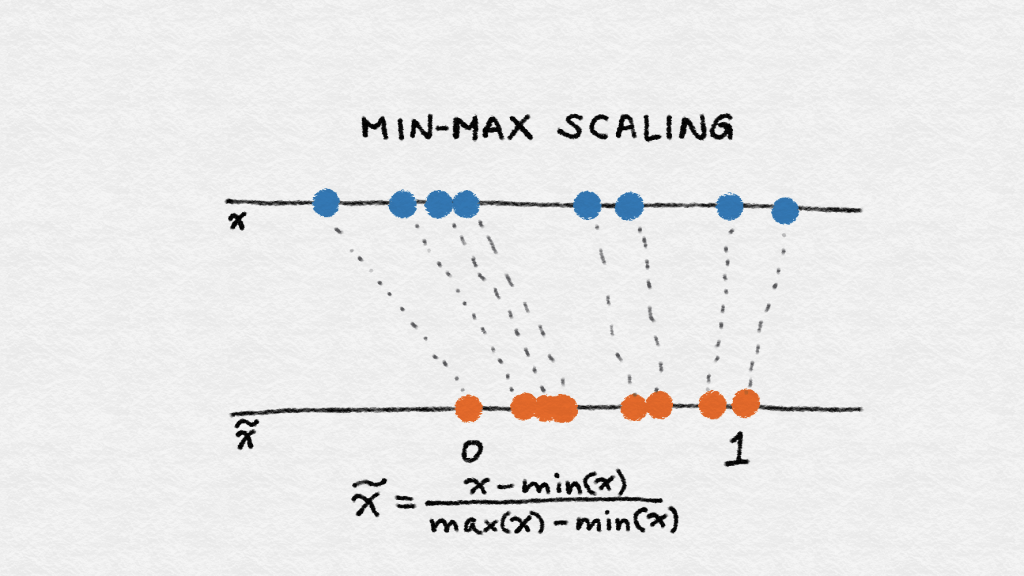

[0,1] 之間:

圖片來源:《Feature Engineering for Machine Learning》一書

# Feature Scaling

from sklearn.preprocessing import MinMaxScaler

sc = MinMaxScaler(feature_range = (0, 1))

training_set_scaled = sc.fit_transform(training_set)

X_train = [] #預測點的前 60 天的資料

y_train = [] #預測點

for i in range(60, 1258): # 1258 是訓練集總數

X_train.append(training_set_scaled[i-60:i, 0])

y_train.append(training_set_scaled[i, 0])

X_train, y_train = np.array(X_train), np.array(y_train) # 轉成numpy array的格式,以利輸入 RNN

X_train 是 2-dimension,將它 reshape 成 3-dimension: [stock prices, timesteps, indicators]

X_train = np.reshape(X_train, (X_train.shape[0], X_train.shape[1], 1))

# Import the Keras libraries and packages

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

from keras.layers import Dropout

# Initialising the RNN

regressor = Sequential()

units: 神經元的數目input_shape參數dropout,這裡設為 0.2return_sequences 設為預設值 False (也就是不用寫上 return_sequences)# Adding the first LSTM layer and some Dropout regularisation

regressor.add(LSTM(units = 50, return_sequences = True, input_shape = (X_train.shape[1], 1)))

regressor.add(Dropout(0.2))

# Adding a second LSTM layer and some Dropout regularisation

regressor.add(LSTM(units = 50, return_sequences = True))

regressor.add(Dropout(0.2))

# Adding a third LSTM layer and some Dropout regularisation

regressor.add(LSTM(units = 50, return_sequences = True))

regressor.add(Dropout(0.2))

# Adding a fourth LSTM layer and some Dropout regularisation

regressor.add(LSTM(units = 50))

regressor.add(Dropout(0.2))

units 設為 1# Adding the output layer

regressor.add(Dense(units = 1))

optimizer: 選擇 Adamloss: 使用 MSE# Compiling

regressor.compile(optimizer = 'adam', loss = 'mean_squared_error')

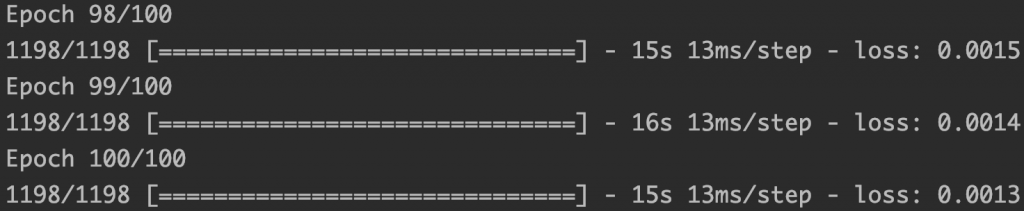

# 進行訓練

regressor.fit(X_train, y_train, epochs = 100, batch_size = 32)

dataset_test = pd.read_csv('Google_Stock_Price_Test.csv')

real_stock_price = dataset_test.iloc[:, 1:2].values

dataset_total = pd.concat((dataset_train['Open'], dataset_test['Open']), axis = 0)

inputs = dataset_total[len(dataset_total) - len(dataset_test) - 60:].values

inputs = inputs.reshape(-1,1)

inputs = sc.transform(inputs) # Feature Scaling

X_test = []

for i in range(60, 80): # timesteps一樣60; 80 = 先前的60天資料+2017年的20天資料

X_test.append(inputs[i-60:i, 0])

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0], X_test.shape[1], 1)) # Reshape 成 3-dimension

predicted_stock_price = regressor.predict(X_test)

predicted_stock_price = sc.inverse_transform(predicted_stock_price) # to get the original scale

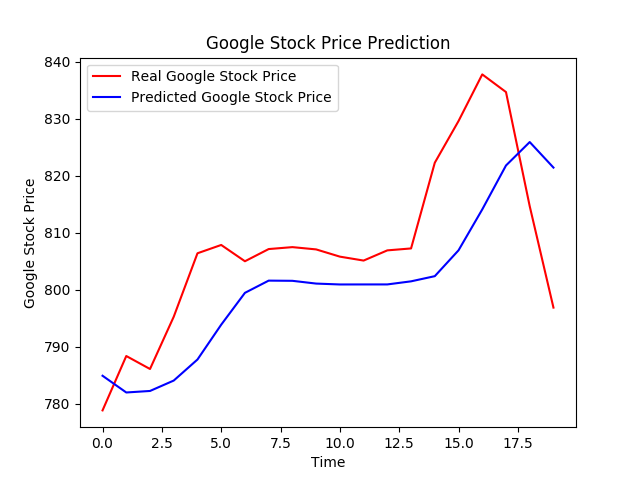

# Visualising the results

plt.plot(real_stock_price, color = 'red', label = 'Real Google Stock Price') # 紅線表示真實股價

plt.plot(predicted_stock_price, color = 'blue', label = 'Predicted Google Stock Price') # 藍線表示預測股價

plt.title('Google Stock Price Prediction')

plt.xlabel('Time')

plt.ylabel('Google Stock Price')

plt.legend()

plt.show()

本次模型的任務是預測股票趨勢,由視覺化結果可以看出模型的預測表現,如預測的趨勢雖大致上跟真實股價是一致但預測的較為平滑。

您好,我想詢問

若我的資料出現這樣的狀況要怎麼處裡 謝謝~~

Error when checking input: expected lstm_27_input to have 3 dimensions, but got array with shape (4987, 10000)